Allow Least Developed Countries to Develop

The pandemic is pushing back the world’s poorest countries with the least means to finance economic recovery and contagion containment. Economic gaps are growing again as COVID-19 threatens humanity.

- Análisis

The pandemic is pushing back the world’s poorest countries with the least means to finance economic recovery and contagion containment efforts. Without international solidarity, economic gaps will grow again as COVID-19 threatens humanity for years to come.

Least developed

While bringing some concessions, the ‘least developed countries’ (LDCs) designation – introduced five decades ago – has not generated changes needed to accelerate sustainable development for all.

The United Nations (UN) General Assembly created the LDCs category for its Second Development Decade (1971-80). Its resolution sought support for its 25 poorest Member States, with Sikkim out after India’s 1975 annexation.

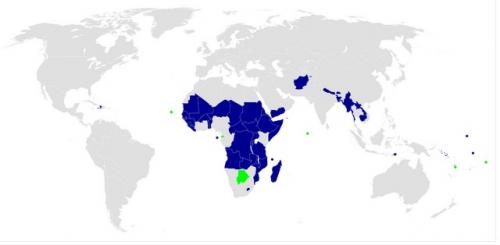

With many others joining, the LDCs list rose to 49 in 2001. Half a century later, with only seven having ‘graduated’ – after meeting income, ‘human assets’ and economic & environmental vulnerability criteria – the 44 remaining LDCs have 14% of the world’s people.

With more than two-thirds in Sub-Saharan Africa, LDCs have over half the world’s extreme poor, surviving on under US$1.9 daily. LDCs are 27% more vulnerable than other developing countries, where 12% are extreme poor.

LDC criteria differ from World Bank low-income country benchmarks for concessional loan eligibility. Some LDCs – especially the resource-rich – are middle-income countries (MICs) disqualified from graduation by other criteria.

Most LDCs have become greatly aid reliant. Despite grandiloquent pronouncements, only 6 of 29 Organization for Economic Cooperation and Development (OECD) ‘development partners’ have kept promises to give at least 0.15% of their national incomes as aid to LDCs.

Chasing mirages?

The UN has organised conferences every decade since to review progress and action programmes for LDC governments and development partners. The first – in Paris – was in 1981, while the fifth will be in Doha in January 2022.

The 2011 Istanbul conference ambitiously sought to graduate at least half the LDCs by 2020. But only three – Samoa (2014), Equatorial Guinea (2017) and Vanuatu (2020) – have done so. Worse, most ex-LDCs have had difficulties sustaining development after graduating.

During the 1980s and 1990s, many developing countries implemented macroeconomic stabilisation and structural adjustment policies from the Washington-based International Monetary Fund (IMF) and World Bank.

These imposed liberalisation, privatisation and austerity across the board, including many LDCs. Unsurprisingly, ‘lost decades’ followed for most of Africa and Latin America.

Botswana, the first graduate in 1994, is now an upper MIC. Its diamond boom enabled 13.5% average annual growth during 1968-90. Unsurprisingly, Botswana’s ‘good governance’, institutions and ‘prudent’ macroeconomic policies were hailed as parts of this “African success story”.

However, the accolades do not sit well. Mineral-rich Botswana remains vulnerable. Right after graduation, average growth fell sharply to 4.7% during 1995-2005, and has never exceeded 4.5% since 2008.

Manufacturing’s share of GDP fell to 5.2% in 2019, after rising from 5.6% in 2000 to 6.4% in 2010. Nearly 60% of its people have less than the Bank’s MIC poverty line of US$5.50 daily.

Botswana remains highly unequal. During 1986-2002, life expectancy fell 11 years, mainly due to HIV/AIDS. When the government embraced austerity, its already weak health system suffered a disastrous brain drain.

Policy independence crucial

Although they have not yet graduated, several LDCs have successfully begun diversifying their economies. Their policy initiatives offer important lessons for others.

Neither Bangladesh nor Ethiopia would qualify as a ‘good governance’ model by criteria once so beloved by the Bank and OECD. Instead, they have successfully intervened to address critical development bottlenecks.

Once considered a ‘basket case’, Bangladesh is now a lower MIC. Diversifying deliberately, rather than pursuing Washington’s policies, it has become quite resilient, averaging 6% growth for over a decade, despite the 2008-09 global financial crisis and current pandemic.

Bangladesh saw the potential for exporting manpower to earn valuable foreign exchange and work experience. In 1976, it agreed to provide labour for Saudi Arabia’s oil-financed boom.

Similarly, as newly industrialised economies no longer qualified for privileged Multi-Fibre Arrangement market access, Dhaka worked with Seoul from 1978 to take over South Korean garment exports.

Bangladesh is also the only LDC to have taken advantage of the 1982 World Health Organization’s essential drugs policy. Its National Drug Policy blocks imports and sales of non-essential drugs. Thus, its now vibrant generic pharmaceutical industry has emerged.

Allow pragmatism

During 2004-19, Ethiopia’s growth averaged over 9%. Poverty declined from 46% in 1995 to 24% in 2016 as industry’s share of output rose from 9.4% in 2010 to 24.8% in 2019.

Avoiding ‘Washington Consensus’ policies, Ethiopian industrial policy drove structural change. Manufacturing grew by 10% yearly during 2005-10, and by 18% during 2015-17.

With improved governance, state-owned enterprises still dominate banks, utilities, airlines, chemical, sugar and other strategic industries. Ethiopia opened banks to domestic investors, keeping foreign ones out. Meanwhile, privatisation has been limited and gradual.

Instead of full exchange rate liberalisation, it adopted a ‘managed float’ system. While market prices were liberalised, critical prices – e.g., for petroleum products and fertilisers – have remained regulated.

Neither Bangladesh nor Ethiopia have embraced central bank independence or formal ‘inflation targeting frameworks’, once demanded by the IMF and others, ostensibly for macroeconomic stability and growth.

Both countries retain reformed specialised development banks to direct credit to policy priorities, while Bangladesh’s central bank has “remained proactive in its mandated developmental role”.

Policy is destiny

In development and structural transformation, ‘path dependency’ implies policy is destiny. LDCs’ current predicaments are largely due to policies from decades ago, pushed by international organisations and development partners.

Reform agendas now should avoid ambitious comprehensive efforts which will overwhelm LDCs with modest resources and capabilities. Also, there is no ‘magic bullet’ or ‘one-size-fits-all’ policy package for all LDCs.

Policies should be appropriate to country circumstances, considering their limited options and difficult trade-offs. They must be politically, economically and institutionally feasible, pragmatic, and target overcoming critical constraints.

OECD development partners must instead meet their commitments and support national development strategies. They must resist presuming to know what is best for LDCs, e.g., requiring them to ape Washington and OECD fads.

Sydney and Kuala Lumpur, Aug 31 2021 (IPS)

Del mismo autor

- Allow Least Developed Countries to Develop 31/08/2021

Clasificado en

Clasificado en:

Pandemia

- Gabriela Ramírez Mendoza 07/02/2022

- Jyotsna Singh 06/02/2022

- Gabriela Ramírez Mendoza 06/02/2022

- Richa Chintan 10/01/2022

- Isaac Enríquez Pérez 03/01/2022